When we build trades with the SteadyTrade Team, we look at several indicators. Even if their charts go back weeks or months, it doesn’t mean much for when it becomes a public company. SPACs and other mergers have the same problem. So, you’re trading on the same hype as everyone else. There’s no chart you can use to build a trading plan. With IPOs, there’s sometimes a spike … and then they slam hard. And they definitely matter to the stock’s prospects.īut when it comes down to it, I treat them in a similar way to IPOs. If you like Wall Street intrigue, all of these details are interesting. Now let’s get to our main question - what do they mean for traders? Is a Reverse Merger Good? Reverse mergers in 2020 gave us hot new stocks like DraftKings Inc. From accounting for less than $1 billion/year a decade ago, they’re now outpacing IPOs. These are some of the reasons that SPAC-style reverse mergers are on the rise. If the SPAC’s shares become valuable, investors can use these warrants to buy the stock at a cheaper price.Īnd if the SPAC tanks, you could use redemption rights to get your money back. These are like call options, but they’re given to SPAC investors for free. They get in on the ground floor of what might be an exciting new stock. These early adopters also get some perks in exchange for their trust. Their reputation helps get traders to buy into the new company.

Superstar investors like Chamath Palihapitiya are at the helm of the best-known SPACs.

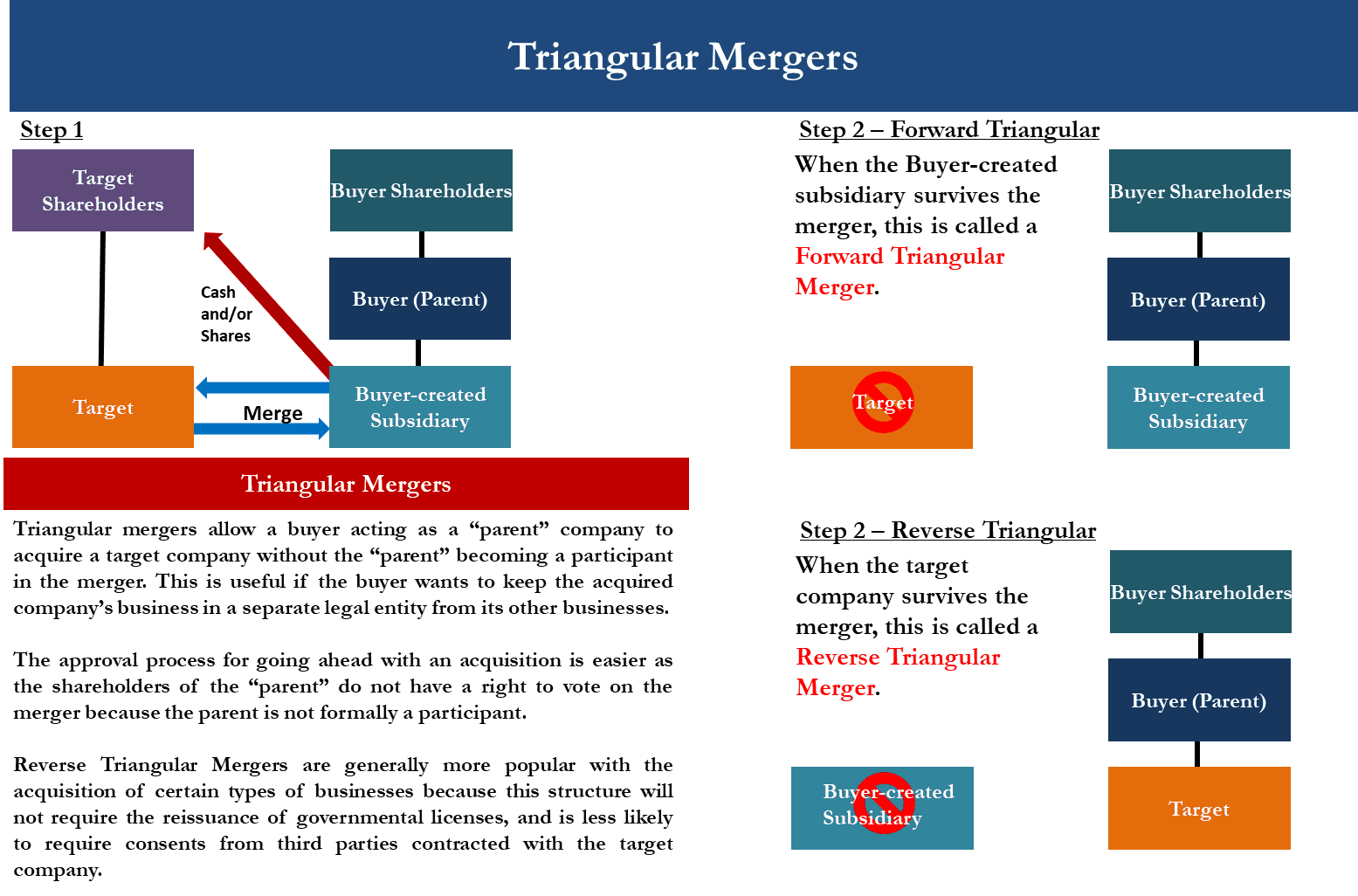

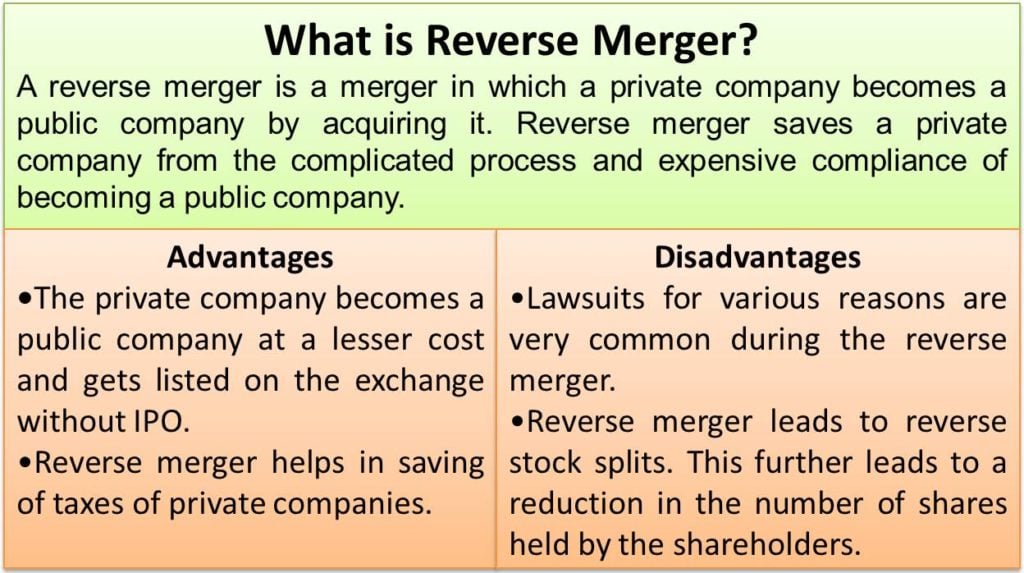

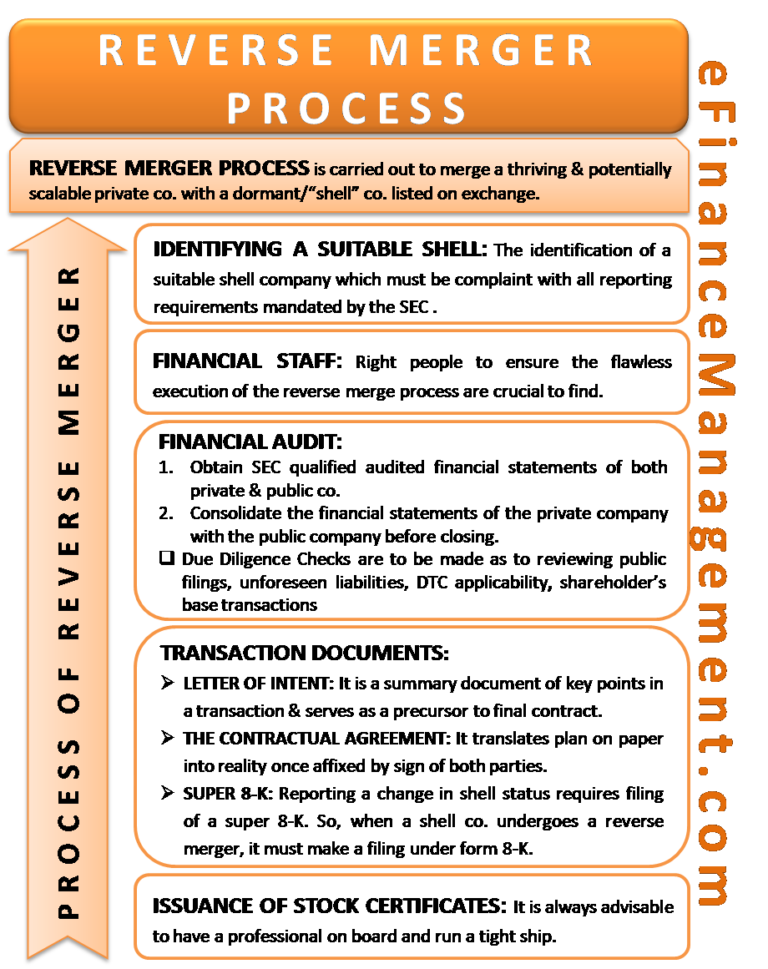

The most common type of reverse merger these days is a SPAC, which stands for special-purpose acquisition company. And that company has both an underlying business - from the private company - and publicly traded shares from the shell company. But sometimes it’s the other way around.Įither way, there’s only one company left at the end of the transaction. Typically, the shell company acquires the private company. When it reverse merges with the private company, that private company goes public IMMEDIATELY. It’s called that because all it has is an organizational structure … but doesn’t have a business. They involve two companies - one that’s already listed. Sounds better for the company, right? That’s one reason they’re on the rise. They let the private company skip the uncertainty and cost of going the IPO route… (NASDAQ: COIN) YTD since April IPO (Source: StocksToTrade) Otherwise, it might have the kind of rough reception Coinbase had…Ĭoinbase Global Inc. Then it has to do a lot more - meet the listing requirements of its future exchange, fill out lots of paperwork, and drum up interest. Along the way, it has to recruit an investment bank to issue its shares and determine the starting stock price. It’s the traditional way for a private company to go public. IPO is short for initial public offering. Reverse mergers and IPOs are the two main routes a company can take to go public.

0 kommentar(er)

0 kommentar(er)